- Arabic

- French

- Russian

- Spanish

- Portuguese

- Turkish

- Armenian

- English

- Albanian

- Amharic

- Azerbaijani

- Basque

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Catalan

- Cebuano

- Corsican

- Croatian

- Czech

- Danish

- Dutch

- Afrikaans

- Esperanto

- Estonian

- Finnish

- Frisian

- Galician

- Georgian

- German

- Greek

- Gujarati

- Haitian Creole

- hausa

- hawaiian

- Hebrew

- Hindi

- Miao

- Hungarian

- Icelandic

- igbo

- Indonesian

- irish

- Italian

- Japanese

- Javanese

- Kannada

- kazakh

- Khmer

- Rwandese

- Korean

- Kurdish

- Kyrgyz

- Lao

- Latin

- Latvian

- Lithuanian

- Luxembourgish

- Macedonian

- Malgashi

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Myanmar

- Nepali

- Norwegian

- Norwegian

- Occitan

- Pashto

- Persian

- Polish

- Punjabi

- Romanian

- Samoan

- Scottish Gaelic

- Serbian

- Sesotho

- Shona

- Sindhi

- Sinhala

- Slovak

- Slovenian

- Somali

- Sundanese

- Swahili

- Swedish

- Tagalog

- Tajik

- Tamil

- Tatar

- Telugu

- Thai

- Turkmen

- Ukrainian

- Urdu

- Uighur

- Uzbek

- Vietnamese

- Welsh

- Bantu

- Yiddish

- Yoruba

- Zulu

កញ្ញា . 24, 2024 06:55 Back to list

Creating a Similar Title Based on 6% DPK 1225 with 15 Words Maximum

Understanding the 6% DPK 1225 A Comprehensive Overview

In the world of finance and investment, the term 6% DPK 1225 represents a specific investment vehicle that has garnered attention for its unique features and potential benefits. This article aims to break down the intricacies of the 6% DPK 1225, providing insights into its structure, relevance, and appeal to investors.

Understanding the 6% DPK 1225 A Comprehensive Overview

One of the primary reasons that investment options like the 6% DPK 1225 attract interest is their potentially stable return. An annual yield of 6% is relatively high when compared to traditional savings accounts or government bonds, especially in a low-interest-rate environment. This makes the 6% DPK 1225 an appealing choice for income-focused investors, such as retirees or individuals looking to diversify their portfolios.

6 dpk 1225

Investors should also be aware of the inherent risks associated with discounted payment notes. While the 6% interest provides a lucrative return, the price paid for the note may also come with an array of risks. Market volatility, credit risk associated with the issuer, and changes in interest rates can all affect the value of DPK notes. Therefore, it's crucial for potential investors to carry out thorough due diligence before committing their funds.

The mechanism of a DPK involves not just the interest earned but also the maturity period of the note. Investors must consider how long they are willing to tie up their capital. Once the DPK matures, the investor receives the full face value of the note, which can be a significant profit, especially when purchased at a discount. Thus, understanding the time horizon and liquidity of the investment is paramount.

Moreover, the current economic climate can significantly affect the appeal of a product like the 6% DPK 1225. In times of economic stability or growth, the demand for higher-yielding fixed-income products usually increases. Conversely, in a recessionary period, risk-averse investors may flock towards safer, more stable investments, potentially affecting the market for discounted notes.

In conclusion, the 6% DPK 1225 represents a compelling investment opportunity for those seeking higher yields within their portfolios. With its designated 6% interest rate, it serves as an attractive alternative to lower-yielding instruments. However, as with any investment, it comes with its own set of risks and considerations. Potential investors should conduct comprehensive research, assess their risk tolerance, and consult with financial advisors to ensure that such an opportunity aligns with their financial goals. This enlightened approach will empower investors to make informed decisions and optimize their return on investment.

-

Korean Auto Parts Timing Belt 24312-37500 For Hyundai/Kia

NewsMar.07,2025

-

7PK2300 90916-T2024 RIBBED BELT POLY V BELT PK BELT

NewsMar.07,2025

-

Chinese Auto Belt Factory 310-2M-22 For BMW/Mercedes-Benz

NewsMar.07,2025

-

Chinese Auto Belt Factory 310-2M-22 For BMW/Mercedes-Benz

NewsMar.07,2025

-

90916-02660 PK Belt 6PK1680 For Toyota

NewsMar.07,2025

-

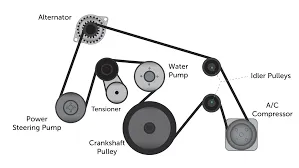

drive belt serpentine belt

NewsMar.07,2025